Technology titan Hewlett Packard Enterprise on Tuesday reported Q4 revenue for the fiscal year ending in October that was in line with Wall Street's expectations. Profit per share came in higher than expected, but it offered an outlook for this quarter's profit below what analysts have been modeling.

The report sent HPE shares down 4% in late trading.

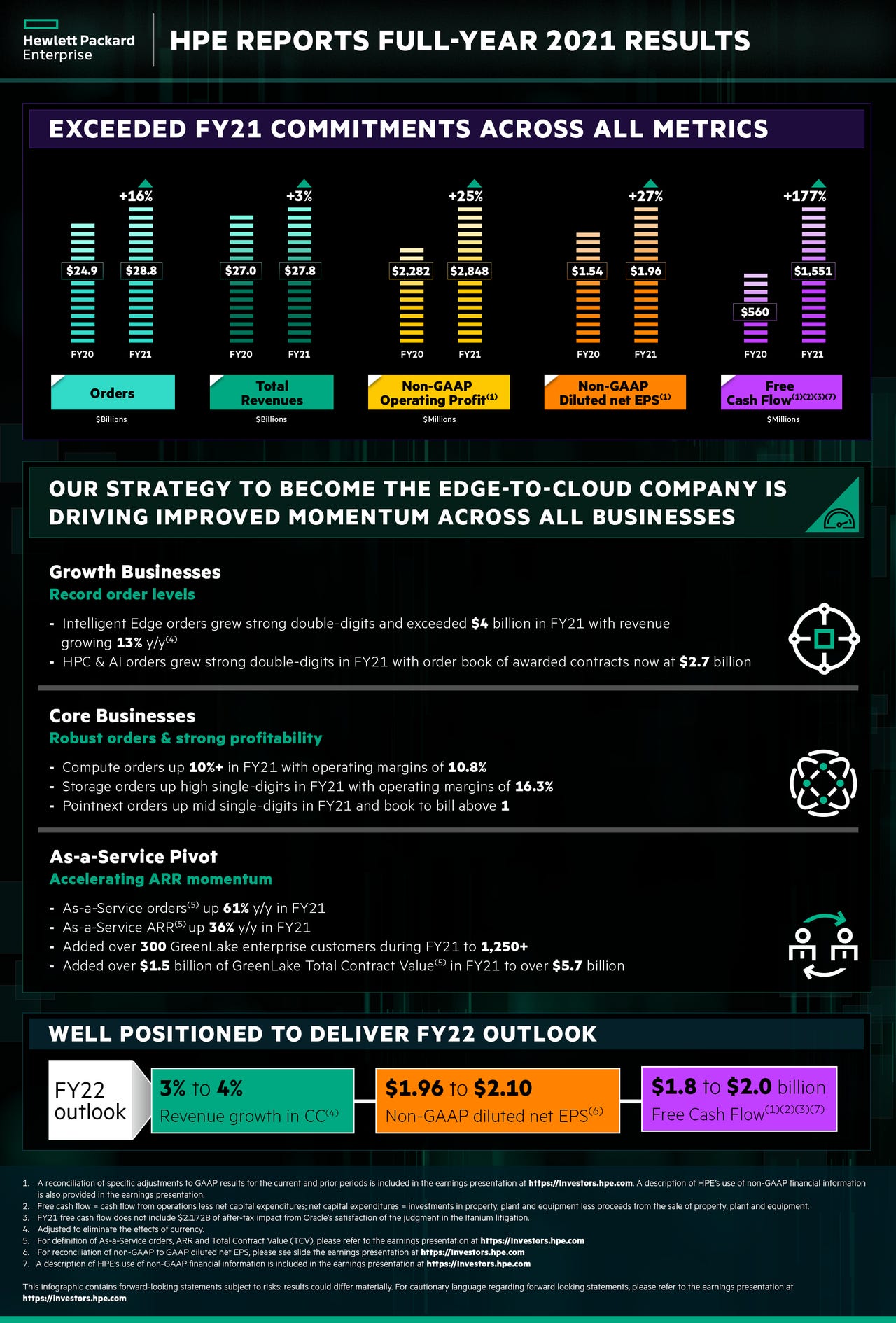

CEO Antonio Neri said in prepared remarks that the company had ended the year "with record demand for [its] edge-to-cloud portfolio," adding that the company is "well positioned to capitalize on the significant opportunity in front of [it]."

Added Neri, "In 2021, we accelerated our pivot to as-a-service, strengthened our core capabilities, and invested in bold innovation in high-growth segments."

Revenue in the three months ending in October rose 2% year over year to$7.4 billion, yielding a net profit of 52 cents a share, excluding some costs.

Analysts had been modeling$7.38 billion and 48 cents per share.

HPE's Storage products revenue rose 3% to$1.3 billion, led by the company's flash-based storage array products. HPE's computer sales rose 1% to$3.2 billion.

HPE's revenue from its "Intelligent Edge" products rose by 4% year over year to$815 million. The company's high-performance computing products and artificial intelligence computing products saw revenue rise 1% to$1 billion.

HPE's financial services revenue rose by 1% to$858 million.

HPE said its annualized revenue run-rate rose by 36% year over year to$796 million. The company's orders for its products that are sold "as-a-service" more than doubled.

The company said the "strong customer demand and growth in orders" meant it could reiterate a forecast made last month at its analyst meeting for the ARR to rise by 35% to 45%, compounded annually, from the fiscal year just ended though its fiscal year 2024.

For the current quarter, the company sees EPS, excluding some costs, in a range of 42 cents to 50 cents. That is below the average Wall Street estimate for a 49-cent profit per share, according to FactSet.

For the full fiscal year 2022, the company reiterated its previously offered forecast for EPS of$1.96 to$2.10, excluding some costs. That is slightly above Wall Street's consensus for a$2.02 profit per share.

HPE also reiterated a forecast for cash flow from operations of$1.8 billion to$2 billion and a pledge to buy back at least$500 million of its shares during the fiscal year.

Tags chauds:

affaires

Les entreprises

Tags chauds:

affaires

Les entreprises