GoDaddy reported better-than-expected third quarter results with strong revenue growth across its domains and business applications units.

The company reported third quarter earnings of$97.7 million, or 58 cents a share, on revenue of$964 million, up 14% from a year ago.

Wall Street was expecting GoDaddy to report third quarter revenue of$945.6 million with earnings of 40 cents a share.

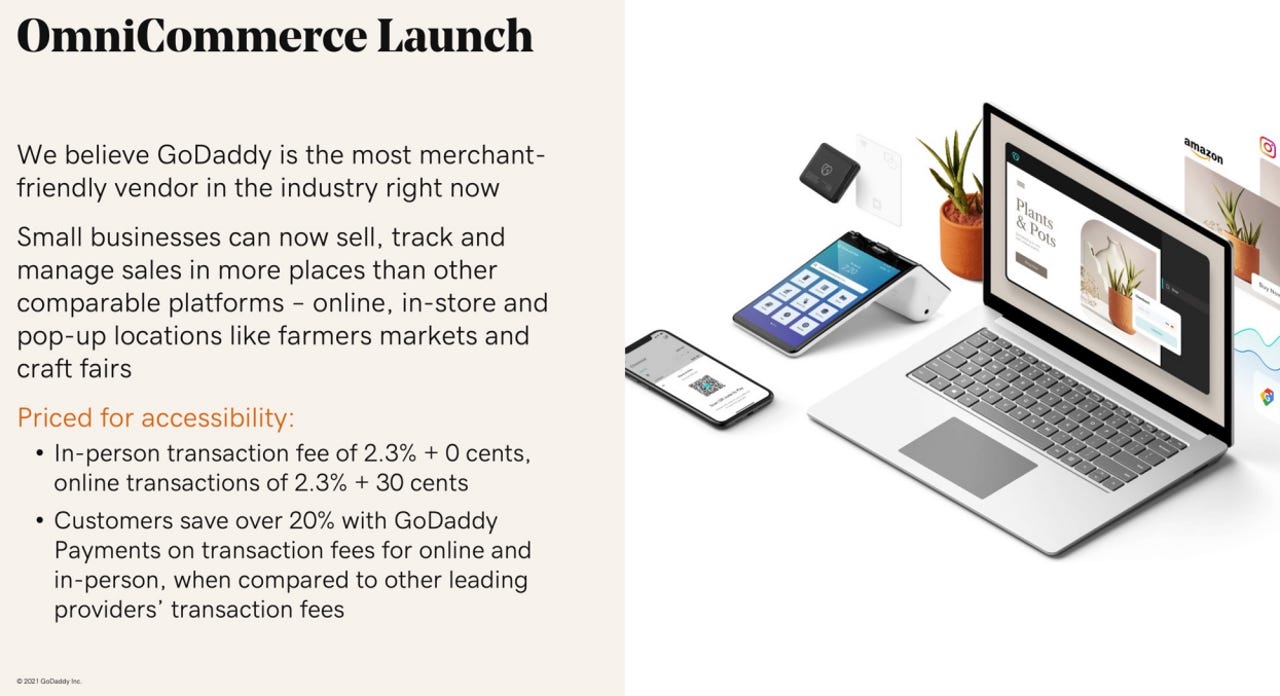

GoDaddy said it was upbeat about the prospects for its hardware and payments efforts. The company recently launched aggressively priced point-of-sale devices and payment processing services to gain market share. In addition, GoDaddy is focused on launching its omnichannel marketing and e-commerce services.

Aman Bhutani, GoDaddy CEO, said:

We've said that 2021 would be about building the products and getting them out by the end of the year, and that 2022 would be about experimentation with pricing, go-to-market strategies, bundling, new SKUs, and promotions. One of the best things about getting the products launched three months early, is that we get to start the experimentation earlier too. We have already begun exploring options for bundles, new SKUs, and go-to-market strategies to make OmniCommerce the easiest and simplest way for a merchant to set up an omnichannel commerce venture.

By the unit, GoDaddy said domains revenue was$453.2 million in the third quarter, up 17% from a year ago. Hosting and presence revenue was$324.7 million, up 7.4% and business application sales were$186.1 million, up more than 20% from a year ago.

As for the outlook, GoDaddy projected fourth quarter revenue of$970 million, up 11% from a year ago. Analysts were modeling$971.3 million. For 2021, GoDaddy projected revenue of about$3.765 billion, up 14% from a year ago. Unlevered free cash flow for 2021 will be about$960 million.

GoDaddy said it will continue to invest in technology and development and hold marketing spending flat sequentially.

Tags chauds:

finances

Tags chauds:

finances